At the end of each lease renewal, ask yourself whether or not you would open up a new office in this location, if you had to do it again. Depending on the strength of the local commercial real estate market, inquire about subletting rates to see if it’s worth staying or if there are better options “out there”. Also, look into the possibility of renegotiating your lease. This is especially important if you’re analyzing the possibility of closing a given location. Since occupancy is one of the largest fixed expenses in a real estate organization, renegotiating a lease could help to regain margin needed to sustain a viable business operation.

For multi-office firms, map out location and determine in as much detail as you can where business is coming from, in order to analyze if and where opportunities for consolidation exist. Analyze costs savings less expected breakage (attrition of agents) vs. staying the course. Determine what the payback period would be.

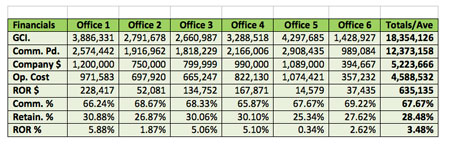

If the above represented your company, here are a few questions that you might need to consider.

- Will office 5 continue to be profitable in the current economic climate?

- Why was only .34{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} ROR generated given $4,297,685 in GCI?

- Is Office 5 located near enough another location to consider consolidation?

- How much breakage would we expect from Office 5 agents if they were asked to relocate?

- Can Office 2 be far behind Office 5’s situation, or are there mitigating circumstances that would cause you to keep Office 2 opened?

- In general, which managers are performing well and which are under-performing against their objectives?