Whether you’re running a multi-office brokerage, or you’re running your own niche role, one thing is for certain: in the Real Estate business you will always be “running” -running to make sure your operations are covered, running to keep your clients happy, running to improve profitability. It’s hard to break that pattern. There is so much to do and time spent sitting is time spent wasted, right?

“Before you journey, observe the wind carefully, detect its direction, and then follow it. You will get to your destination twice as fast with half the effort.” Chin-Ning Chu

The wind is a great source of power, but how can we use it to make more money?

“Before you can improve anything you have to measure it on the right ruler.” Wendy Hamlin

So before we start to change something, we should look at where that thing is relative to where we want it to be. For example, Knowing that your heart is “beating quickly” doesn’t help nearly as much as knowing it is beating 80 bpm when a cardiologist says it should be 65bpm. Similarly, we want to earn more money, but until we know how much we spend, a balance of “$10” or even “$10,000” is a meaningless number.

Let’s apply this to the Real Estate business. Each person should know his/her totals for sides (transactions), pendings, and average sales price, and have an idea how many sides are needed to cover their business expenses plus the desired profit. If we aren’t measuring and tracking price changes, commission rates and commission splits that drive our revenues, then we can look up at the end of a year and find the results are very different than our expectations.

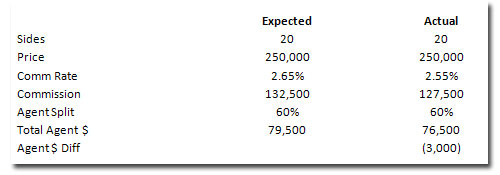

In the case below, the price and sides are exactly what we expected, but seasonality and market forces moved commission rate -.1{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}. If this agent isn’t focusing on commission rates, s/he could realize $3000 less in income than s/he should have had from those sales (even more if that $3000 would have moved the agent to a higher split). By tracking commission rate trends, s/he can adjust a strategy to recapture some of that lost rate. Further, an agent who tracks where s/he is against a commission schedule is one who can give a little extra push to jump up the schedule and make more money.

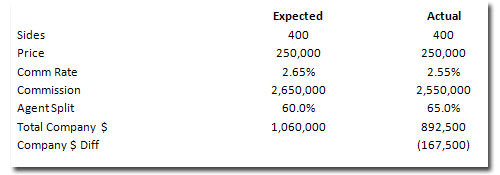

From a company perspective, let’s assume in addition to the scenario above that the agent split does go up in the process. If the company is spending money based on what it expects for sides and price, that company will discover a shortfall of $8,375 for that one agent alone. For a company doing 400 sides per year, it helps turn a “seasonality and market” loss into a gain of $167,000!

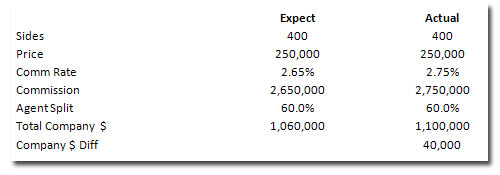

Alternatively, let’s say that instead of the commission rate going down, the only change was that Commission Rates went UP by .1{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c}. In this scenario, we have an extra $40,000 more than we expected.

So we’ve measured it. We have numbers. Now what?

At a minimum we now have knowledge that can lead to a better use of money—we’ll know whether to cut back expenses or whether we may have more money to invest in a re-emerging market. The sooner we can jump on either of those tasks, the better prepared we will be for a wind direction change.

If all we do is watch what happens, we run the risk of being blown off course. We need to be able to use the wind as our tool no matter which direction it blows. A sailboat does this by catching the wind in the sails and expertly navigating the boat towards its destination with the rudder. For us, we need to figure out what causes the averages to move (the wind direction) and then we need to drive changes (use the rudder) to go through it. Once we understand how to harness our wind’s energy and sail the most tactical course to our destination, then we can proactively adapt to our market and situation rather than react to it and make more money all around.

What drivers can you look at that will help you work with the wind?