The affordability quotient for buyers is extraordinary at this time. In fact, it is difficult to find a good reason why qualified buyers should wait any longer. Money is available for buyers with a good credit history, home prices have fallen over the past four years and in June 2011, mortgage rates remain at historic lows. Still with all of this, some qualified buyers still seem to be waiting for a “better time” to buy.

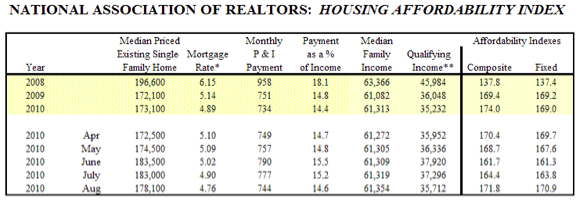

The NATIONAL ASSOCIATION OF REALTORS® affordability index measures whether a typical family with median family income could qualify for a mortgage loan on a typical home (median priced existing single family home) given the prevailing mortgage interest rates. A value of 100 indicates that a typical family has exactly enough income to qualify. As the score increases to levels above 100, homes become increasingly more and more affordable.

“Housing affordability remains near record highs. NAR’s housing affordability index (HAI) registered a reading of 166.7 in March. February’s index reading was revised to 174.4. The dip in affordability in March was due primarily to the monthly increase in home prices. Still, the HAI is 30.8 percentage points higher than a year ago” – NAR May, 2011

The composite Housing Affordability Index (HAI) score of 166.7 in March means that families earning the median family income have 166.7{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of the income necessary to qualify for a conventional loan covering 80 percent of a median-priced home. The calculation assumes a down payment of 20 percent and a qualifying ratio of 25 percent, which means that the monthly P&I payment cannot exceed 25 percent of the median family monthly income.

A quick examination of the chart above shows us that the HAI averaged 169 during 2010. In addition, there is currently 91{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} employment (to take a positive view) in the U.S. A quick examination of any local publication shows that mortgage monies are available with less the 20{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} down, if buyers have good credit. When we put all this together, it spells great opportunity for the home buyer and one that may not repeat itself for a very long time indeed.

A quick examination of the chart above shows us that the HAI averaged 169 during 2010. In addition, there is currently 91{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} employment (to take a positive view) in the U.S. A quick examination of any local publication shows that mortgage monies are available with less the 20{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} down, if buyers have good credit. When we put all this together, it spells great opportunity for the home buyer and one that may not repeat itself for a very long time indeed.

Wouldn’t it make therefore make a great deal of sense for the real estate community to get this message out to the consumer? If it is done successfully, wouldn’t a “Home Affordability” program help motivate many first time and ‘move-up’ buyers, who are ready to pull the trigger, yet flat scared to do it? Challenging times create new opportunities, but tapping into opportunity requires a clear cut strategy.

There are several things that brokers and sales agents can do to help consumers assist the buying (and selling) public. They include, but are not limited to:

1. Create an educational forum for first time buyers – This can be done via group seminars or simply through communication campaigns whereby agents ‘get the word out’ to their spheres of influence via social media.

2. Create urgency and overcome fear– Be sure that move up buyers are also made aware of all of the positive reasons to act now. Short term “loss” may well be long term gain.

3. Hold open house campaigns for properties in the starter-home price range – After all, if this is an opportune time for first time buyers, then selling this inventory also creates some “move up” situations. Done this way, open houses become a targeted prospecting opportunity for sales agents.

4. Train (or re-train) sales agents in qualifying buyers – With how quickly affordability has changed, some agents could use the refresher.

5. Re-engage homeowners of your current listings in the property selection process – In many cases, homeowners have slowed or even halted the home selection process due to poor prospects of selling. However, as your Home Affordability program begins to take hold, some transactions will hinge upon the current homeowners ability to decide.

It’s time to get message out. I fully understand all of the economic challenges that we are embroiled in, but I also know that every challenging market benefits certain people and sectors of society, in some way. The opportunity is now for the home buyer and move up buyer. Let’s look our current economic challenges strait in the eye and proactively move toward clear-cut solutions. After all, isn’t that what true professionals do?