Building expense is a formidable, recurring fixed cost for real estate organizations and the fact that office size increased dramatically between 1990 and 2005 only added to the severity of this situation. During the same period of time, real estate agents were becoming increasingly less and less attached to the idea of working in a ‘formal’ office environment and were progressing toward ‘home’ and other ‘remote-type’ office arrangements. The result of these combined factors for many companies has been a super-developed real estate infrastructure that exceeds capacity requirements. Given all of this, the time for a new approach to managing physical office space is clearly upon us.

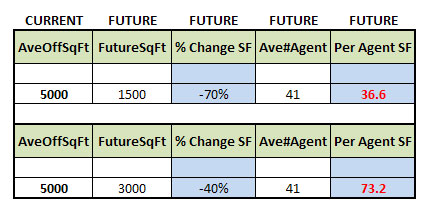

According to Steve Murray, Editor of Real Trends, the average size for all of Real Trends Top 500 companies during 2007 was 124 square feet per agent with an average number of 41 agents per office. This works out to approximately 5000 Sq ft. per-office on average. Making the assumption that this remained relatively constant during 2008, I have based all calculations using 5000 SF as the status quo office size.

The table below demonstrates the ‘before-change’ and ‘after-change’ effects of reducing office size. I have used 1,500 Square Feet (SF) as a typical size for an “Urban” location and 3,000 SF for the “Suburban” model. This is in harmony with my observations that progressive urban offices (such as the Intero’s Andare office in San Jose, CA and @properties in Chicago) tend to be eficient and highly technological, while suburban locations may require added scale along with technologies in order to maintain a competitive image.

So what?

So what?

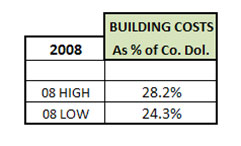

What is the current relationship between square footage and building costs? How are ratios currently tracking? Where are the opportunities for positive change?

The spreadsheet below shows the “Benchmark Ratio Range“ of the relationship between company dollar and building expense as it exists in today’s pre-change real estate environment. Note the heavy toll that building (aka Occupancy) costs are taking on real estate operations. When building costs absorb an average of 24.3{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} to 28.2{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of company dollar, it is challenging for many companies achieve a positive return on revenue.

What if?

What if?

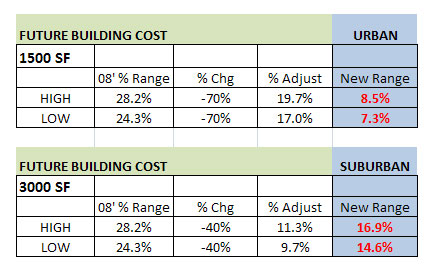

What if companies were to restructure their building costs according to urban and suburban square footage sizes described above? What would be the result?

These questions can be answered by determining how building costs would change when reduced by the same percentages shown in the tables above. Then, using this new concept of office size, calculate the new relationship between company dollar and building costs, and then determine how company dollar retention would change.

As you review the visual below, please recall that the typical current building costs average as high as 28.2{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of company dollar. After adjusting for reduced office size, the new range for building cost changes from a low of 7.3{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} in urban areas to a high of 16.9{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of company dollar in suburban areas, thus reducing Building Expenses between 40{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} and 70{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} as targeted in our model.

What is the result?

What is the result?

When former building costs are replaced with the newly calculated range and placed into the financial model, the resulting differential in company dollar committed to building costs is dramatically lowered. But how does all of this really help? Here are some thoughts:

- Reducing office size in this manner could, in itself, create a positive ROR for real estate companies, providing all other expenses remain constant.

- Additional revenue could also be used to fund home-office programs, offer additional marketing and provide managerial support where needed.

- Steps as outlined in #2 could bolster talent attraction results

- Proper reallocation of resources in this way should also bolster agent retention.

- Since consumers typically visit only reception and conference areas, office size reduction will in most cases, be seamless to buyers and sellers.

Steps to consider in getting started

- Perform a risk assessment – It is critically important to have a grasp on company culture and to understand risk factors before proceeding with this.

- Create a new vision around building size – How much reduction is enough for the culture? How much is too much? How much change is required in order to ‘right the ship’?

- Renegotiate current leases – Given the current economics of the commercial real estate market, many firms have reduced building expense through lease renegotiation alone.

- Sublet portions of existing buildings – This is self explanatory, but a key advantage of subletting is the ability to remain in the same location, albeit with lower building costs.

- Seek out new locations – Once your vision is clear and building needs are determined, embark upon the mission of seeking out new and better-suited situations.