The affordability quotient for first time buyers is particularly favorable at this time. In fact, when all aspects of the buying process are considered, it is difficult to find a good reason why first time buyers should wait any longer. Money is available for buyers with a good credit history, home prices have fallen over the past four years and in December of 2008 mortgage rates fell to a 37 year low. However with all of this, first time buyers still seem to be waiting for a “better time” to buy.

The NATIONAL ASSOCIATION OF REALTORS® affordability index measures whether a typical family with median household income could qualify for a mortgage loan on a typical home (median priced existing single family home) given the prevailing mortgage interest rates. A value of 100 indicates that a typical family has exactly enough income to qualify. As the score increases to levels above 100, homes become increasingly more and more affordable.

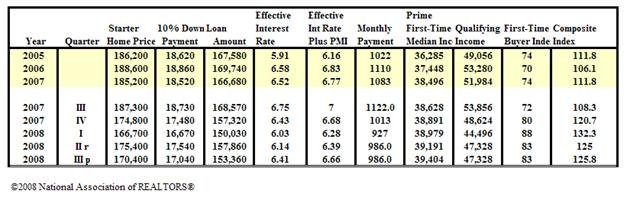

The composite Housing Affordability Index (HAI) score of 125.8 (2008 IIIp below) means that families earning the median household income have 125.8{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of the income necessary to qualify for a conventional loan covering 80 percent of a median-priced home. The calculation assumes a down payment of 20 percent and a qualifying ratio of 25 percent, which means that the monthly P&I payment cannot exceed 25 percent of the median family monthly income.

NAR Quarterly Housing Affordability Index for First-time Buyers

(Click for larger image)

(Click for larger image)

A quick calculation shows us that the HAI averaged 127.7 during the first three quarters of 2008. In addition, there is currently 93{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} employment (to take a positive view) in the U.S. The government tax credit of $7,500 for first time buyers is available to families who earn up to $150,000 in joint income, making a huge number of families able to qualify, and the government is likely to add more incentives for buyers as the next phase of economic stimulus kicks in. Putting all this together spells great opportunity for the first time buyer and one that may not repeat itself for a very long time.

Wouldn’t it therefore make a great deal of sense for the real estate community to get this message out to the consumer? If it is done successfully, a first time buyer program could stimulate many ‘move-up’ buyers, who are ready to purchase but cannot sell their current homes to also buy a property.

Now is not the time for fear, or for simply riding the tides of the marketplace. Challenging times create new opportunities, but real estate professionals must employ clear cut strategies in order to tap into that potential. It is important that we, as an industry, lead the way and show consumers how to achieve their goal of moving affordably.

There are several things that brokers and sales agents can do to lead that charge and help consumers capture current market opportunities. They include, but are not limited to:

-

Creating educational forums for first time buyers – This can be done via group seminars or simply through communication campaigns whereby agents ‘get the word out’ to their spheres of influence.

-

Create urgency and overcome fear – Be sure that buyers are made aware of all of the positive reasons to act now.

-

Hold open house campaigns for properties in the starter-home price range – After all, if this is an opportune time for first time buyers, then the real estate community needs to make the appropriate inventory readily available. This also presents a targeted prospecting opportunity for sales agents.

-

Train (or re-train) sales agents in qualifying first time buyers – In some cases, this is a skill that agents simply haven’t used for a long time or skills they honed to begin with if their entrance into real estate began within the last ten years.

-

Re-engage homeowners of current listings in the property selection process – In many cases, homeowners have slowed or even halted the home selection process due to poor prospects of selling. However, as your first time buyer program begins to take hold, some transactions will hinge upon the current homeowners ability to decide.

Anyway you look at it, now is the time to get message out. I fully understand all of the economic challenges that we are currently embroiled in, but I also know that every challenging market benefits certain businesses or some sector of society, in some way. The opportunity is now for the first time buyer. Let’s look our current economic challenges in the eye and proactively move toward clear-cut solutions.

After all, isn’t that what true professionals do?

Opportunity Knocks for First-Time Buyers

The affordability quotient for first time buyers is particularly favorable at this time. In fact, when all aspects of the buying process are considered, it is difficult to find a good reason why first time buyers should wait any longer. Money is available for buyers with a good credit history, home prices have fallen over the past four years and in December of 2008 mortgage rates fell to a 37 year low. However with all of this, first time buyers still seem to be waiting for a “better time” to buy.

The NATIONAL ASSOCIATION OF REALTORS® affordability index measures whether a typical family with median household income could qualify for a mortgage loan on a typical home (median priced existing single family home) given the prevailing mortgage interest rates. A value of 100 indicates that a typical family has exactly enough income to qualify. As the score increases to levels above 100, homes become increasingly more and more affordable.

The composite Housing Affordability Index (HAI) score of 125.8 (2008 IIIp below) means that families earning the median household income have 125.8{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} of the income necessary to qualify for a conventional loan covering 80 percent of a median-priced home. The calculation assumes a down payment of 20 percent and a qualifying ratio of 25 percent, which means that the monthly P&I payment cannot exceed 25 percent of the median family monthly income.

NAR Quarterly Housing Affordability Index for First-time Buyers

A quick calculation shows us that the HAI averaged 127.7 during the first three quarters of 2008. In addition, there is currently 93{0a8e414e4f0423ce9f97e7209435b0fa449e6cffaf599cce0c556757c159a30c} employment (to take a positive view) in the U.S. The government tax credit of $7,500 for first time buyers is available to families who earn up to $150,000 in joint income, making a huge number of families able to qualify, and the government is likely to add more incentives for buyers as the next phase of economic stimulus kicks in. Putting all this together spells great opportunity for the first time buyer and one that may not repeat itself for a very long time.

Wouldn’t it therefore make a great deal of sense for the real estate community to get this message out to the consumer? If it is done successfully, a first time buyer program could stimulate many ‘move-up’ buyers, who are ready to purchase but cannot sell their current homes to also buy a property.

Now is not the time for fear, or for simply riding the tides of the marketplace. Challenging times create new opportunities, but real estate professionals must employ clear cut strategies in order to tap into that potential. It is important that we, as an industry, lead the way and show consumers how to achieve their goal of moving affordably.

There are several things that brokers and sales agents can do to lead that charge and help consumers capture current market opportunities. They include, but are not limited to:

Anyway you look at it, now is the time to get message out. I fully understand all of the economic challenges that we are currently embroiled in, but I also know that every challenging market benefits certain businesses or some sector of society, in some way. The opportunity is now for the first time buyer. Let’s look our current economic challenges in the eye and proactively move toward clear-cut solutions.

After all, isn’t that what true professionals do?

Related Posts

AREAA A-List Winners

Congratulations to our A-List winners! The annual AREAA A-List is a compilation of the best

2024 Nomination Award Winners

Community Involvement Award Winners Congratulations to BHGRE Main Street Properties from Pensacola, Florida, for their

2024 NAHREP Top 250 Latin Agents Report

BHGRE has an outstanding presence in the recently published 2024 NAHREP Top 250 Latino Agents

Congratulations to all BHGRE® RealTrends Verified and The Thousand Winners!

Better Homes and Gardens® Real Estate is proud to announce the affiliated agents and teams recognized in

BHGRE® Brokerages Recognized in the 2024 RealTrends 500

The Better Homes and Gardens® Real Estate network extends its sincere congratulations to the affiliated

How to Sell a High-End Home During Any Market

Considering the value of high-end homes, it’s understandable that luxury homeowners and agents would be